What goes into creating a financial plan

5 minute read

Ever wonder what a financial plan really is or how it’s made? While each financial planner has their own unique process, I’ll share mine to give you an idea why financial planning is so valuable and what to expect when talking with a good financial planner.

I use a 3-step process involving several meetings over 12 weeks.

Step 1: Getting To Know Eachother

Introduction Meeting

The first step in my process is a short 15-minute call to learn more about each other. This is where we get a general idea of where you’re at today and what’s on your mind. I’ll also share a bit about myself, my background, clients I work with, and the services I provide. By the end of the call we should know if we are a good fit for what you are looking for and what I can provide.

Discovery Meeting

To give you the best advice, I need to know what makes you tick, what you value, what is most important to your current self, your future self, and your family. At this point, if you are excited to continue working with me, and I feel I can bring you value then we will commit to a partnership on paper. After this meeting, you will be sent a link to sign up for my financial planning tool and your personal portal, where you will be guided through a data gathering process and begin linking accounts to bring everything under one roof.

Step 2: Together, we will make a plan

Get Organized

I will help sort through and organize all financially relevant data in the most convenient and efficient way so you can breathe a sigh of relief knowing exactly where everything is. The financial planning portal is an incredible tool that allows you to:

Conveniently link and track all your investments and savings in one place,

Track progress toward your short-term and long term goals

Evaluate alternative scenarios

Analyze potential risks and how to proactively reduce their impact

Discover strategies to fast-track you toward goals and save valuable tax dollars

Many advisors prefer to keep access to their software to themselves and provide periodic updates. We live in a modern connected world. You can see everything else online, why not your financial plan in real time?

Explore Possibilities

This is where we find the ‘how to…’ I will start by getting a lay of the land and then collaborate together to explore both possibilities and trade-offs. By the end of the meeting you will have an idea of what the future could look like and what you need to do to get there.

Brainstorm Strategies & Analyze Tactics

This is where I will do the heavy lifting to see if we can fast-track your way to accomplishing your most important goals. I will also take a comprehensive look at your financial life including investments, insurance, estate planning, taxes, and income to make sure you are covered for life’s hiccups and optimizing your current resources.

Step 3: I’ll get you to where you want to go

Plan Presentation & Implementation Meeting

I will present my recommendations and together we will decide what the path forward will be. We’ll prioritize implementation and start by tackling your top two priorities today and create a schedule on your timetable for tackling the rest. Typically, clients prefer an implementation schedule of between 12-24 months – but it is up to you. We can go as fast or slow as you are ready. Implementation will likely include:

Current Cash Flow/Budgeting

Debt Reduction

Investment & Savings Action Plan

Estate Planning (wills, trusts, etc.)

Insurance Needs (fill gaps and/or get rid of excess)

Tax & Income Efficiency

College/Education Funding

Employee Benefits Coordination (for those still working)

Income Planning (for retirees): social security maximization, distributions strategy, and other guaranteed income optimization

Monitor, Review & Adjust

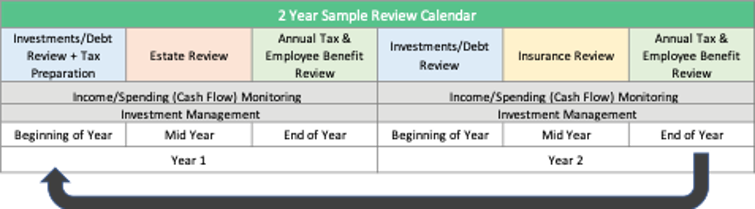

Financial planning is not a one-time event; it is a process. Our job is to prepare you for life’s curveballs and make adjustments along the way. We will have formal update meetings 2-3 times per year. In between, I will do monthly check-ins and am available during times of crisis. Below is a sample of my service calendar and what is covered.

Contact me to learn more about the benefits of financial planning and explore how we can work together to help you achieve your goals.